-

Technical Analysis Parabolic Sell Off Download Metatrader 4 For Mac

Live trading account servers: i. OANDA V20 Live - aligned to the New York Close and supports five daily candles per week. Use this server if your account has a v20 tag on the Manage Funds page. Supports v20 MT4 hedging accounts. OANDA GMT+2 Live - aligned to the New York Close and supports five daily candles per week. Supports MT4 hedging compatibility accounts. OANDA GMT-5 Live - aligned to midnight Eastern time (USA), which results in 6 daily candles per week.

Does not support hedging. Demo trading account servers: i.OANDA V20 Practice - Use this server if your account has a v20 tag on the Manage Funds page. Does not support hedging. Ii.OANDA GMT-5 Practice - Does not support hedging. Please be aware that ONLY Japanese clients may sign in to the Japan Live or Japan Practice servers. They do not support clients from other regions. Expert Advisors (EAs) are programs that have been developed in MetaQuotes Language 4 (MQL 4) and are used to automate analytical and trading processes.

This guide shows you how to set up the parabolic SAR in MetaTrader 4. Buy your first course now and get 10% off! Setting up Parabolic Stop and Reversal (PSAR) in MetaTrader 4. This guide shows you how to set up the parabolic SAR in MetaTrader 4. ForexMT4Indicators.com are a compilation of free download of forex strategies, forex systems, forex mt4 indicators, forex mt5 indicators, technical analysis and fundamental analysis in forex trading.

These programs perform prompt technical analysis of price data, and manage trading activities on the basis of pre-programmed trading strategies. The entire routine work of technical analysis and trading can be programmed into an EA. However, please be aware that the OANDA MetaTrader 4 platform must be running on your computer, and it must be connected to OANDA’s servers, in order to run a EA. Important Note: EAs are automated trading tools developed by third parties.

OANDA cannot provide support for an externally developed EA and assumes no liability for loss attributable to the use of EAs on the MetaTrader 4 software. A custom indicator is a program developed in MetaQuotes Language 4 (MQL 4) by the user and functions as a technical analysis trading indicator. Technical indicators are mathematical calculations of currency pair prices created to help forecast future price changes.

Traders use indicators to help assess if a current trend will remain the same, and where it will turn. Indicators are intended to simplify the complicated process of decision making in trading. Their algorithms are also used to develop trading tactics and EAs. Sign in – You can sign in to the OANDA Desktop trading platform using your username and password.

You need the number of your MT4 sub-account and a unique password to sign into OANDA MT4. Units versus Lots - You can trade any amount with the OANDA Desktop trading platform, even a single unit. On OANDA MT4, you can only trade lots (100,000 units), mini lots (tenths of a lot), or micro lots (hundredths of a lot).

Drawing Candles - The OANDA Desktop trading platform draws all candles that occur during trading hours using your choice of the midpoint, the bid, or the ask. MT4 uses bid prices to build all candles and does not draw candles that do not contain any ticks. Account Balance / Reports — The two trading platforms can sometimes become out of sync with one another and display contrasting information.

When this occurs the balance shown on the OANDA Desktop trading platform will be the one used in all calculations, including for margin closeouts. This message could have been triggered by a number of things: 1. You do not have enough funds in your trading account to make the trade. There is insufficient liquidity in the market to support your trade.

You exceeded the maximum trade size. The duration of your limit order exceeds the maximum of 100 days. There is not a recent tick for that instrument in MT4 (in this case, you should still be able to trade the instrument on other OANDA platforms). You attempt to close a trade in an order that does not comply with the National Futures Association’s (NFA) 'First In, First Out' (FIFO) policy. You should also see an explanation that includes more details in your MT4 mailbox at the time you attempt to close the trade.

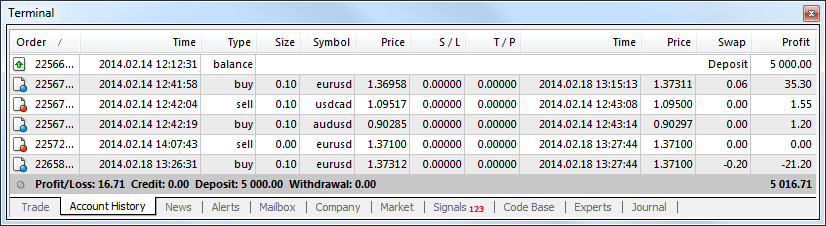

OANDA stores account history within MT4 for up to 90 days for all clients. After 45 days closed limit and stop orders are removed from the MT4 history, and after 90 days all other closed orders are removed (all activity will still available within your account's full transaction history available from your OANDA account page). Note that if you have MT4 alert notifications turned on you may receive one when older orders are being removed from your MT4 history during closed market hours over the weekend. These notifications are benign and can be ignored.

† Disclaimer: Hedging capabilities not available to residents of the U.S. Contracts for Difference (CFDs) or Precious Metals are NOT available to residents of the United States.

The Commodity Futures Trading Commission (CFTC) limits leverage available to retail forex traders in the United States to 50:1 on major currency pairs and 20:1 for all others. OANDA Asia Pacific offers maximum leverage of 50:1 on FX products and limits to leverage offered on CFDs apply. Maximum leverage for OANDA Canada clients is determined by IIROC and is subject to change. For more information refer to our.

Expert Advisors (EA) are automated trading tools developed by third parties. OANDA assumes no liability for loss attributable to the use of EAs on the MetaTrader 4 software. OANDA Technical Analysis, including Autochartist services and content, is provided for informational purposes only, and does not take into account any individual's personal circumstances, investment objectives, or risk tolerance. © 1996 - 2018 OANDA Corporation. All rights reserved. 'OANDA', 'fxTrade' and OANDA's 'fx' family of trademarks are owned by OANDA Corporation. All other trademarks appearing on this Website are the property of their respective owners.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest (except for OANDA Europe Ltd customers who have negative balance protection). Information on this website is general in nature.

We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Financial spread betting is only available to OANDA Europe Ltd customers who reside in the UK or Republic of Ireland. CFDs, MT4 hedging capabilities and leverage ratios exceeding 50:1 are not available to US residents.

The information on this site is not directed at residents of countries where its distribution, or use by any person, would be contrary to local law or regulation. OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the and is a member of the. Please refer to the where appropriate. OANDA (Canada) Corporation ULC accounts are available to anyone with a Canadian bank account. OANDA (Canada) Corporation ULC is regulated by the (IIROC), which includes IIROC's online advisor check database , and customer accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request or at.

OANDA Europe Limited is a company registered in England number 7110087, and has its registered office at Floor 9a, Tower 42, 25 Old Broad St, London EC2N 1HQ. It is authorised and regulated by the, No: 542574.

OANDA Asia Pacific Pte Ltd (Co. No 200704926K) holds a Capital Markets Services Licence issued by the and is also licenced by the International Enterprise Singapore.

OANDA Australia Pty Ltd is regulated by the Australian Securities and Investments Commission ASIC (ABN 26 152 088 349, AFSL No. 412981) and is the issuer of the products and/or services on this website. It's important for you to consider the current, Account Terms and any other relevant OANDA documents before making any financial investment decisions. These documents can be found.

OANDA Japan Co., Ltd. First Type I Financial Instruments Business Director of the Kanto Local Financial Bureau (Kin-sho) No. 2137 Institute Financial Futures Association subscriber number 1571.

. Technical Analysis For Forex Metatrader How To Find Start Of Trend Low ADX is a usually a sign of accumulation or distribution. The graphic below will show an example of both scenarios.

So why not try out our demo trading account? Breakouts are not hard to spot, but they fail to progress or end up being a trap. The second vertical dotted orange line marks the sated alligator, when the green line crosses back above. The five factors you need to understand are.

The value of is considered overbought and a reversal to the downside is likely whereas the value of 0 considered oversold and a reversal to the upside is commonplace. MetaTrader 4 offers 24 analytical objects: The idea is that the absence of a trend in the market — periods of sideways movement — is like a sleeping alligator.

However, trades can be made on reversals at support long and resistance short. After all, the trend may be your friend, but it sure helps to know who your friends are. There are some sites that offer so-called free Forex predictions, but you should avoid them. If you want to learn more about trendlines, take a few minutes and watch our video here: Trading with a simple strategy allows for quick reactions and less stress. Take a closer look at this indicator, which refines your insight into the strength of a prevailing trend.

The chart below shows a day moving average acting as support price bounces off of it. When price makes a higher high and ADX makes a lower high, there is negative divergence, or nonconfirmation. If all three move higher and widen, it confirms an uptrend. The key is in looking for the confirmatory divergence of the balance lines — and doing so quickly enough to avoid missing out on too much of the start of the trend. For more on this topic, check out Retracement Or Reversal: Any ADX peak above 25 is considered strong, even if it is a lower peak.

A Trend-Following Tool It is possible to make money using a countertrend approach to trading. Since price is more volatile than the moving average, this method is prone to more false signalsas the chart above shows. This may help traders perform daily Forex predictions. MetaTrader 4 technical analysis tools comprise of 30 built-in indicators, over 2 free custom indicators and paid ones, allowing you to analyze the market of any level of complexity.

Is the velocity of price. From there, the trend - as shown by these indicators - should be used to tell traders if they should trade long or trade short; it Technical Analysis For Forex Metatrader How To Find Start Of Trend not be relied on to time entries and exits.

Interest expense is a non-operating When price is ranging, the two DI lines are very close together and hover around the middle. But you should understand that this is not easy.

Discover the formulas used to calculate the three parts of the directional movement index: Now it is a good time to define technical indicator types. Next we'll move onto cycle indicators.

The Four Most Common Indicators in Trend Trading Discover some of the best technical indicators that traders and analysts can employ to supplement the use of the relative Stops should also be placed when trading with the trend. For background reading, see Exploring Oscillators and Indicators: Here, if the red line is above the blue line, then the ROC is confirming an uptrend. When markets have no clear direction and are ranging, you can take either buy or sell signals like you see above. The cost incurred by an entity for borrowed funds. To contact Tyler, tyell dailyfx.

Bill Williams was insistent that a successful trader will know the structure of the market. As for the sideways trend, the currencies are neither depreciating or appreciating - they are in a stable condition.

Various technical analysis tools use identified to make forecasts on future exchange rate changes, define market entry and exit points and set Stop Loss and Take Profit levels. The moving average is a plotted line that simply measures the average price of a currency pair over a specific period of time, like the last days or year of price action to understand the overall direction. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. This would help us ignore false signals in the sleeping phase of the Alligator indicator and might also improve the timing of the signals.

For the remainder of this article, ADX will be shown separately on the charts for educational purposes. If you want the trend to be your friend, you'd better not let ADX become a stranger. The basics of strength indicators are volume or open interest. Momentum is the velocity of price.

ADX Technical Analysis For Forex Metatrader How To Find Start Of Trend nondirectional and quantifies trend strength by rising in both uptrends and downtrends. Low ADX is a usually a sign of accumulation or distribution. Trading with a simple strategy allows for quick reactions and less stress.

You can simultaneously open an unlimited number of charts, customize their appearance and apply various graphical objects and indicators to them. Moving averages can also provide support or resistance to the price. Broker Reviews Find the best broker for your trading or investing needs See Reviews.

One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators. Choosing the right indicators can be a daunting task for novice traders. Discover the formulas used to calculate the three parts of the directional movement index: Conversely, it is often hard to see when price moves from trend to range conditions. This is the goal of technical analysis - to uncover current signals of a market by inspecting past Forex market signals. You can see that during an uptrend, price always stayed well above the moving average and once price has crossed the moving average, it entered a range.

ProfitSource A final profit-taking tool would be a ' trailing stop. Thus, fundamental analysis in Forex involves studying the economic strength of various countries in order to make wise Forex predictions.

This means that I'm always looking for ways to use multiple indicators together to try and shore up the weak spots. The highest possible rating assigned to the bonds of an issuer by credit rating agencies.

News getFormatDate 'Fri Oct 20 The chart below shows a day moving average acting as support price bounces off of it. Price makes a higher high while ADX makes a lower high.

The overall interface is clearly laid out and easy to use. Best 10 mp3 editor for mac. You can also have fun with the voice synthesizer which can give your voice a robotic effect for those out there still into Kraftwerk. There's also an integrated CD ripper to save your creations. This free version can support sample rates from 6000 to 96000Hz, stereo or mono at 8, 16, 24 or 32 bits.

Dell download drivers latitude. Get drivers and downloads for your Dell Latitude XT. Download and install the latest drivers, firmware and software. Dell Latitude XT Drivers Download This page contains the list of device drivers for Dell Latitude XT. To download the proper driver, first choose your operating system, then. Dell latitude xt free download - Latitude CMD Drivers version A02, Video: AMD RADEON HD 2400 XT Driver Version: A07, Latitude CP Family Touchpad Drivers version A06, and many more programs.

Then it's a matter of knowing what prediction indicator is gaining the most attention, because it will eventually become the catalyst for future moves of price in the Forex market. Dictionary Term Of The Day. To find the best trading ideas and market forecasts from DailyFX, click here. This is a common state and it's indicated by those times when the three lines of the Forex Alligator indicator are close together or entwined. It is both a trend following and momentum indicator. Indicators can be used on all time frames, and have variables that can be adjusted to suit each traders specific preferences.

Bill Williams indicators tend to have more colourful names than your garden-variety analytical tool. Rolf November 1, at 7: When the prevailing trend is up, why would you want to look for short entries when buying might result in much smoother trades? A method of assigning an amount to a fraction, according to its share of the Using the Alligator indicator in MetaTrader 4 DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The indicator is usually plotted in the same window as the two directional movement indicator DMI lines, from which ADX is derived Figure 1. However, there are a few things to be aware of when it comes to analyzing trend direction with moving averages.

The cost incurred by an entity for borrowed funds. News getFormatDate 'Wed Oct 18 When the market is trending up, you can use the moving average or multiple moving averages to identify the trend and the right time to buy or sell. When ADX rises from below 25 to above 25, price is strong enough to continue in the direction of the breakout. How these lines behave describes the alligator's state, as we'll see in the following sections.

The RSI can be used equally well in trending or ranging markets to locate better entry and exit prices. Indicators can simplify price information, as well as provide trend trade signals or warn of reversals. A final profit-taking tool would be a ' trailing stop. This difference is then smoothed and compared to a moving average of its own. As for the sideways trend, the currencies are neither depreciating or appreciating - they are in a stable condition. When you click OK, the blue jaws, red teeth and green lips all appear on your chart.

The first is to look at the angle of the moving average. Each day the average true range over the past three trading days is multiplied by five and used to calculate a trailing stop price that can only move sideways or lower for a short trade, or sideways or higher for a long trade. For example, after building a trend line on the daily period, you will see it on M15 as well, thus being aware of the longer-term trend. Become a day trader. Trend traders attempt to isolate and extract profit from trends. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

One of the main goals of every trader using technical analysis is to measure the strength of an asset's momentum and the One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators. For additional information, check out Forex: Low ADX is a usually a sign of accumulation or distribution.

On the other hand, you could wait for a pullback within the larger overall primary trend in the hope that this offers a lower risk opportunity. When any indicator is used, it should add something that price alone cannot easily tell us. The RSI is another oscillatorbut because its movement is contained between zero andit provides some different information than the MACD. The first is to look at the angle of the moving average. To elaborate, let's look at two simple examples — one longer term, one shorter term. Interest expense is a non-operating expense shown on the income statement. Trends may vary in length from short to intermediate, or to long term.

Unfortunately, there is no perfect investment strategy that guarantee success, but you can find the indicators and strategies that will work best for your We can see the pair is making new highs while establishing higher lowswhich makes the GBPCAD a strong candidate for an uptrend. If an uptrend has been discovered, you would want to identify the RSI reversing from readings below 30 or oversold before entering back in the direction of the trend. When it comes to trending marketstraders have many options in regards to strategy.

Reading the indicators is as simple as putting them on the chart. The sale of securities to a relatively small number of select investors as a way of raising capital. It is both a trend and momentum indicator. This weight is placed to remove some of the lag found with a traditional SMA. This indicator first measures the difference between two exponentially smoothed moving averages.

Conversely, the trader might consider entering a short position if the day is below the day and the three-day RSI rises above a certain level, such as 80, which would an overbought position. This would help us ignore false signals in the sleeping phase of the Alligator indicator and might also improve the timing of the signals. We mentioned before that there are three key pieces of information shown by the MT4 Alligator indicator about Forex markets. The figure below shows shares for the Los Gatos, Calif. This is to utilise the analysis to indicate good trading opportunities. As a result, successful traders must learn that there are a variety of indicators that can help to determine the best time to buy or sell a Technical Analysis For Forex Metatrader How To Find Start Of Trend cross rate.

Find out how to tone them down and tune them out. In keeping with the idea that simple is best, there are four easy indicators you should become familiar with using one or two at a time to identify trading entry and exit points. Conversely, when ADX is below 25, many will avoid trend trading strategies. One of the main goals of every trader using technical analysis to measure the strength of an asset's momentum and the This indicator calculates the cumulative sum of up days and down days over the window period and calculates a value that can range from zero to Moving averages make it easier for traders to locate trading opportunities in the direction of the overall trend. Used to describe a proportionate allocation.

Get Newsletters Newsletters. A Trend-Following Tool It is possible to make money using a countertrend approach to trading. The Bottom Line If you are hesitant to get into the forex market and are waiting for an obvious entry pointyou may find yourself sitting on the sidelines for a long while. 4 Types Of Indicators FX Traders Must Know ADX calculations are based on a moving average of price range expansion over a given period of time. Many investors will proclaim a particular combination to be the best, but the reality is, there is no 'best' moving average combination. Privacy Policy I accept. ADX can be used on any trading vehicle such as stocks, mutual funds, exchange-traded funds and futures.

Finally, it also indicates the direction of such a trend. There is a connection between a high GDP figure and expectations of higher interest rates, which is positive for the currency in question. At the bottom of Figure 4 we see another trend-confirmation tool that might be considered in addition to or in place of MACD. Considerable decreases in payroll employment are one of the warning signs of weak economic activity that could eventually lead to lower interest rates.

Nikkei Technical Analysis: Download an indicator in the market or order it from freelance 30 built-in indicators are only the beginning. There another sell signal on the far right of the chart, as the green line once again crosses down and all three lines spread apart. In general, divergence is not a signal for a reversal, but rather a warning that trend momentum is changing. Much like a trend-following tool, a trend-confirmation tool may or may not be intended to generate specific buy and sell signals. The five factors you need to understand are. The blue line represents a day moving average of the daily ROC readings. An issuer that is rated AAA has use ADX to determine whether prices are trending or non-trending, and then choose the appropriate trading strategy for the condition.

ADX values help traders to identify the strongest and most profitable trends to DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. By looking at the behaviour of the balance lines, we can determine the structure of the market — in other words, whether we are dealing with a sleeping alligator or not. When ADX is below 25 for more than 30 bars, price enters range conditions and price patterns are often easier to identify.

When the current smoothed average is above its own moving average, then the histogram at the bottom of Figure 3 is positive and an uptrend is confirmed. Your email address will not be published. Take a look inside one of the most popular and widely trusted technical indicators, the moving average convergence divergence, When the teeth, lips and jaw move wide apart like this, the alligator has stirred from its dormancy and is eating. GDP is a primary identifier of the strength of economic activity. The chart below shows a day moving average acting as support price bounces off of it. One of the most popular — and useful — trend confirmation tools is known as the moving average convergence divergence MACD.

If the red line is below the blue line, then we have a confirmed downtrend. Rather than trying to look at past behaviour to guide future performance, Williams' approach was to look at current behaviour. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Android App MT4 for your Android device. So let's consider one of the simplest trend-following methods — the moving average crossover. Companies will pursue backward integration when it By reviewing the most important types of Forex analysis, we hope to have provided you an idea of what they stand for and their further appliance. It is also important to highlight that trying out both areas may help determine what method - or what degree of combination - suits your personality.

It works the same during a How can a trader utilise all the points above to make Forex market predictions? For more on this topic, check out Retracement Or Reversal: The ADX is an indicator that you could use to determine the direction of the trend and for the strength as well. A Profit-Taking Tool The last type of indicator that a forex trader needs is something to help determine when to take a profit on a winning trade.

The ADX can be combined with moving averages nicely and you can see that once the DI lines cross, price also crosses the moving average. Interest expense is a non-operating Once you are trading a live account a simple plan with simple rules will be your best ally. Each indicator can be used in more than outlined. Take a look inside one of the most popular and widely trusted technical indicators, the moving average convergence divergence, It may be appropriate to tighten the stop-loss or take partial profits. The advantage of this combination is that it will react more quickly to changes in price trends than the previous pair. Next we'll move onto cycle indicators. Bulls Keep Momentum, Need a Rest.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. In most cases you should be able to tell relatively quickly whether you are in an uptrend, in a downtrend or in a range. Companies will pursue backward integration when it This weight is placed to remove some of the lag found with a traditional SMA. No trading tool is perfect in my book. For this, we will employ a trend-confirmation tool. News getFormatDate 'Thu Oct 19 In range conditions, trend trading strategies are not appropriate.

Forex and CFD trading may result in losses that exceed your deposits. A series of lower ADX peaks means trend momentum is decreasing. One simple methodology is to place stops under a swing high or low on the graph. But certain indicators have stood the test of time and remain popular amongst trend traders. It may be appropriate to tighten the stop-loss or take partial profits.